by suprememarketing | Apr 23, 2025 | FHA

The recent FHA Mortgagee Letter announcing the removal of eligibility for non-permanent resident aliens has understandably raised concerns across the industry. For many, FHA has historically been a reliable option for serving these borrowers. At Supreme Lending, we...

by suprememarketing | Oct 17, 2024 | FHA, Home Loans, Homebuyers, Homeowners

Discover the Program Highlights of an FHA 203(k) Renovation Loan Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and...

by suprememarketing | Oct 9, 2024 | FHA, Home Loans, Homeowners

All You Need to Know About the FHA 203(h) Disaster Relief Loan Program When natural disaster strikes, the devastation it leaves behind can be overwhelming, especially if your home is damaged or destroyed. At Supreme Lending, we know how difficult it can be to rebuild...

by suprememarketing | Mar 13, 2024 | Conventional, FHA, Home Loans, Homeowners, Refinance

The decision to refinance* your mortgage is a strategic move that can have a profound impact on your financial well-being. There are several types of situations when refinancing might provide specific benefits and unlock potential savings. It’s important that...

by suprememarketing | Feb 20, 2024 | FHA, Home Loans, Homebuyers

When it comes to buying a home, which could be one of the biggest investments you make, it’s important to understand your financing options. While a Conventional loan is more traditional, FHA loans have seen a rise in popularity due to more flexible guidelines. Let’s...

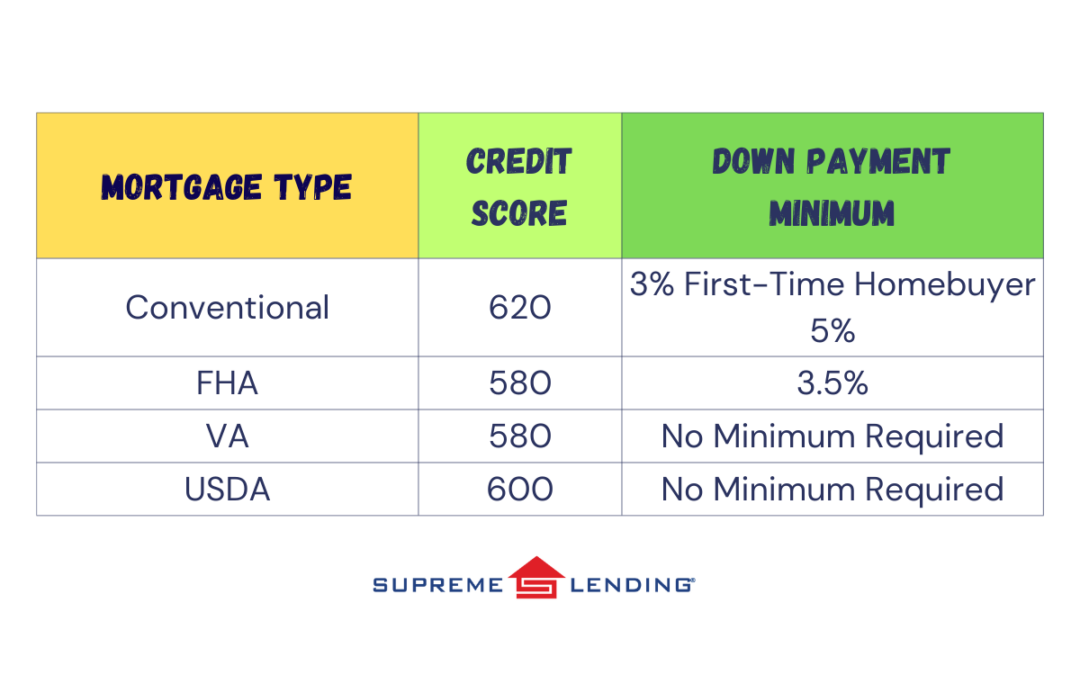

by suprememarketing | Feb 12, 2024 | Family, FHA, Home Loans, Homebuyers

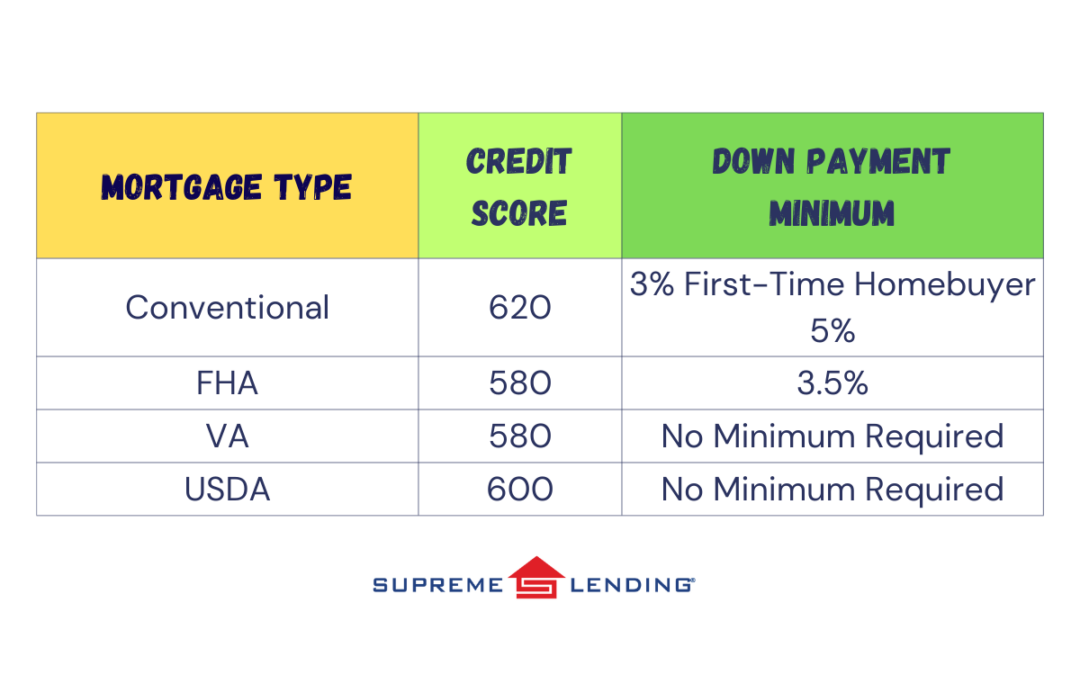

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most...